Tuesday, March 16, 2021

Monday, March 15, 2021

What Janet Yellen JUST Said About New $1,400 Stimulus Checks

Tuesday, March 9, 2021

The STRADDLE

What the Hell is a Straddle?, my wife asked. "Its not a Strangle", I said. And my wife looked kind of weirdly into my eyes. "What do you want to do??"

I said, a Strangle needs two hands or strikes. "WHAAAAT??"

A Straddle only needs to legs to stand on. Her eyes were questioning my integrity. WHAT?

Yes, a Strangle needs two hands /Strike Prices. A Straddle only ONE. Like you standing with your legs straddling a little creek.

The Straddle is an OPTION SPREAD TRADE. You make money on either side of the creek but not in the creek. So the underlaying has to move by a certain amount to either side. This is one way to make money in any market. You protect your underbelly and gain if the market moves up or down. But it has to move with a certain speed (against Theta, Time Decay), and the creek's width (Premium Costs of the other leg and Commissions) and before a certain date (the expiration date)!

The idea of the straddle is that as the stock moves up in price, the long call becomes more valuable. Although the long put will lose value at the same time, it won't lose value as quickly as the call gains value. In addition, there is a lower limit as to just how much value the put can lose -- it can only go to zero. Thus, as the stock rises in price, the net effect is that the straddle gains in value.

The major problem with a straddle is that it consists of two options: a put and a call. As we're purchasing both options at the money, the entire value of the two premiums is Time Value. As Time Value is not "real" in that it has no inherent value and it decreases to zero as the option approaches expiration, we have the crux of the problem: The stock must move, and move soon, to recover the money lost by the erosion of time in the trade.

There are two ways the trade will be profitable. First, obviously, the stock's significant move would increase the value of one option while simultaneously decreasing the value of the other option, albeit at a slower rate. Second, both options could increase in value. The only way that can happen is to have the volatility of the options increase. All other variables in the Black-Scholes Option Pricing Model will affect puts and calls in opposite directions.

If the volatility of the option increases, then the option premium will increase, and the possibility of the stock moving will also increase (the basic concept of what volatility is measuring). Thus, if you can find a stock with relatively low volatility, which is increasing, the value of the straddle will be increasing and the stock will be likely to move either up or down -- a double chance for profit.

To be successful in trading straddles, we need to find a stock whose volatility is low but is about to increase as the stock begins to move. This may sound like real guessing at first, but in reality, it is not too hard to discover. The primary, most reliable reason for an increase in volatility and for the stock price to move is news. News can be anything from court decisions to new product discoveries to accounting "irregularities" to earnings announcements.

Of the various news possibilities, earnings reports are the easiest to predict and the most common. Every quarter, each publicly traded company is required by the

Securities and Exchange Commission

to report earnings, meaning there are four chances for the stock to move unpredictably each year. Further, each announcement will tend to be made at about the same point in each quarter.

Read the basics at https://www.thestreet.com

The Straddle can be a longer term trade. You have to give it time to evolve. Here was the setup this morning.

I usually do not hold options until expiration or within 2 weeks thereof. If the Option does not move at all, which is very unlikely, then the trade will lose all the money. If the stock moves past commission fees and about 6% either direction we start making money.

These trades are great if you dont know the direction of the market and if you dont want to star at the screen all day long and watching candles. This trade goes either way as long as the market MOVES!

Now at the end of the day, Markets closing in one hour. Day done.

Here 15-Minutes charts of MRNA

Monday, March 8, 2021

The GM Entry for the Calendar Spread was wrong. WHY.

After you do your fundamental Analysis you chose your ENTRY by Technicals. Technicals will NOT tell you what stock to buy or sell. Technical will not tell you expected earnings or what the daily True Range of the underlaying is. This will only do fundamental analysis.

We take a look at the DAILY Charts or even the weekly.

It became apparent that the ENTRY was chosen when GM tried to break through the $57 Level. But instead of breaking through it created a Double Top and retraced from thereon forth.

I usually start with the Fibonacci Retracement at Ground ZERO, which I define as most recent LOW or the Opening Price, or a Resistance or Support Level.

We can see that GM made a YUGE move in January 2021 hit the $57 Level and fell back. It hit the 50% level and tried a second time to break the $57 Level without success. There is no guarantee in any of these moves. It is all psychology!

In the same way as young adults pushing the limits just to fail over and over again the more experienced dudes lean back and think: Yeah, try it. I will come in the next wave when we are sure we broke the level. So the more experienced traders wait while the younger ones get burnt.

We rushed in too. Too early. We bought the Calendar Spread on February 8th, 2021. The game is NOT about how much money you can make but to stay in the game and make another day, week, month or year! Staying in the game. There have been THREE options at the GREEN TRIANGLE on FEB 08.

WAIT for break through and buy the DIP on the Retracement. Or

WAIT and wait for the failure to break, retracement and buy the DIP at the rebounce!

WAIT and if nothing of this happen then rethink and abandon the whole idea of BUYING.

Outcome of the wrong decision.

At one point the position was down by 60%. Not good! You cannot afford many of those, ever.

The trade is also going on for 19 days now, which represent 4 trading weeks! 5 days = 1 week.

Entering the position today with the same Strike and Expiration Date would have saved $900 on 4 contracts.

Buying the position when GM closed above Mid Bollinger at 53.50. The Option Price for the Call was about $5.00 a contract. Beside saving $900 for opening the position it also would have given us an additional P/L of about $330.

All over all without being detailed on the exact numbers, choosing the correct ENTRY is important. When you go to the casino you want to be the bank and have ALL ODDS in your favor. When you trade well you put ALL ODDs in your favor. You are the Bank.

The Details in the CALL Option

We still have 102 days to go. Plenty of time. All that matters is if the position will recover until expiration date. And I am absolutely convinced that GM will pull this off. Here is their new video.

GOOD NEWS TODAY?

The Biden Administration is spending more tax money on everything. Big companies will do well. All the new Green Agenda will bring billions of Dollars and subsidies to the automobile Industry.

Dow Jones hit the 32,000 Point level!!

Volatility is down.

The Germans are doing well.

S&P500 slightly up

Sunday, March 7, 2021

Hello Pal, another Chino TikTok Spyware?

We remember this announcement?

VANCOUVER, BC, Feb. 24, 2021 /CNW/ -- Hello Pal International Inc. ("Hello Pal" or the "Company") (CSE:HP) ( Frankfurt: 27H) (OTC:HLLPF), a provider of rapidly growing international live-streaming, social messaging and language learning mobile apps, is pleased to announce the commencement of marketing operations for its livestreaming services in the Middle East market, with a focus on the United Arab Emirates, Saudi Arabia, Egypt and Bahrain.

Hello Pal International Inc. logo (PRNewsfoto/Hello Pal International Inc.)

After having consistently achieved monthly revenues of over CAD 2 million over the past several months, and following the arrival earlier last year of industry veteran Vincent Chai as Senior Vice President of Operations, the Company has started to focus on expanding its revenue sources to markets other than the China livestreaming market.-------------------------------------------------

Then I went in on February 25th at 0.78. This is what I posted then. Daily candles. The stock stayed flat through the rest of the week. Then Monday and Tuesday it went up big time and people came flying in and also jumped onto the flying train. I was in a good mood counting my monies. The stock was playing well. My position doubled now. Great I thought. So I bought more on Tuesday the 2nd of March and moved the SL up to make a profit even if it all collapses. You never know.

My Break Even Point, BE, moved from 0.78 to 0.92. HP run at 1.30!

Here the details in the 15 min charts.

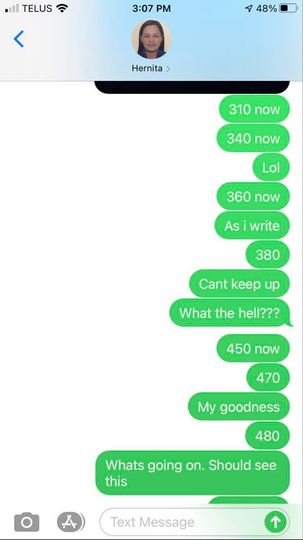

On March the 4th I was paralyzed in front of the screen. HP went up from the beginning. It drew a huge candle in 15 minutes. I remember texting my wife with updates. You know "The Great Candle", the Candle Goddess is appearing to me. Every 5 seconds $100 in my wallet! When I was finished typing the price went up. I was glued to the screen and couldnt believe it!

Why was the third BUY a mistake?

All the Dumb Money was flying in and buying the stock. They were buying from traders that were selling. Then the once that were in longer also started selling. But the more people buying and the orders are lined up the price goes up. Now Yahoo News was read by a lot and the crowed was moving in but was late to the party. When the Sellers, Bears take over the stock loses on value since more people start selling than buying, hence the price is falling. This happened after 20 minutes into the trading day.

With a steep Candle like this one after quite some huge gain before days you know this cannot go on for ever. So you dont buy into the same scheme as the others. The third buy in was wrong for that reason and reduced the profit!

What could have been done differently?

If you get a candle like this and there is NO obvious NEWS for it or even just hype news you do not BUY you SELL, you short the stock when the momentum retracts. This is a pretty safe bet. Sell on the top at the 78.6% Fibonacci Level and buy back on the 50% Level or do a trailing Stop Loss and go further until you get stopped out. Mostly at the 23.6% Level and the Stock might consolidate and finds new support. This will be then the new price level traders willing to pay. Simple. Doing this instead of staring at the screen like a rabbit on the road could have made myself a profit of 120%. Well, next time guys.

Now it is time to re-evaluate the Stock for holding it for 3 months or so. Is it worth it? What are the numbers saying?

Week 01-05 March in Review

The reason I mentioned last Sunday for terminating some of our positions, has not gone away. The opposite happened. On Monday The VIX Index fell down to the monthly and three monthly average, which is a good sign.

Volatility is the enemy of Hedge Fund Managers and the best friend of traders.

While Fund Managers like the constant move upwards (LONG) or downwards (SHORT) to increase their earnings a trader only can make money when the market moves up and down in short term. This is called volatility, And the "JUMP TO ACTION" Threshold for me is 25% above the 3 Month Average, the yellow line, The green line is the monthly average, 20 day simple moving average. So if the green and the yellow line are entangled we are good! If the green line takes off the market becomes volatile and tends to go down since we are in a long time bullish market. It will not get steeper even though this could happen theoretically.

We saw the increased volatility last Thursday and then the holding pattern on Friday that made me think of deleting some of our positions. Bad positions will get worse and good positions might turn bad. Thus, you have to act. Whats the plan Dan?

I do not trade the first 30-45 minutes after the markets open due to the fact that Investment Banks and overnight orders flushing the markets and make it very volatile in ANY direction. By the time of 10 and 10:30 EST the markets cooled and we will see a direction and we can read the VIX.

The reason for closing our positions disappeared on Monday and Tuesday, and it came back into play on Wednesday and Thursday. I was waiting for the VIX to go through the Threshold and it didnt. But Volatility was up and our positions lost money! And then on Friday it collapsed.

The SPX recovered slightly on Friday's last blue Candle. But still it runs below weekly on monthly average!

The German DAX was down and so is Australian Dollar and Copper, signs of cooling off.

Best thing that could happen next week is the the SPX will hit 4,000 and the DJI 32,000 and GM $57.00 and TSM $142. Wishful thinking.

Hence we gained back some losses and I made a huge win on Chino's Hello Pal position.

And what went wrong with entering the GM and TSM trades!

See next posts.

Tuesday, March 2, 2021

Start into Week March 01--05

The preparation from last weekend was good. Even though and that saved my neck, I do not trade the first 30 minutes of opening!

How and why? Usually the first momentum is wrong, most of the time. Banks and Funds have their orders all piled up and flush the market. Our "Traders" at Investment Banks were busy processing orders from clients. What ever it is process it and see whats coming out.

So after 20-30 minutes the market starts to settle and a direction starts to forming, which usually goes until lunch time in New York, 10-11 o'clock Mountain Time. After that the market starts to reverse again or stays flat for the most part.

If the initial direction in the opening was right that means all orders go one way. And if this is what it is we jump on it at 10 am EST. If the initial move was wrong the market starts to turn and we get a better price. Thats why I stay out for 30 minutes.

The initial direction on Monday was correct and hence I only closed United Guardian for a small win and left all other trades on!

They all recovered for the most part from last week and so on Tuesday!

The best pick I did was buying 1,000 Stocks of HELLO PAL, another Chinese gadget company competing with TIKTOK. They go big in the Arab world showing Burka dances if allowed. Great tool to spy on citizens, made in China! Another tool to dumb down western society. I bought in.

QUOTE PRNewswire, 24 FEB 2021:

"After having consistently achieved monthly revenues of over CAD 2 million over the past several months, and following the arrival earlier last year of industry veteran Vincent Chai as Senior Vice President of Operations, the Company has started to focus on expanding its revenue sources to markets other than the China livestreaming market.

The Company has already begun to work with several key partners to begin this expansion, including those with an established network of livestreaming hosts in the Middle East countries such as the United Arab Emirates, Saudi Arabia, Egypt and Bahrain. Such partners will help bring in a diverse community of livestreaming hosts and provide livestream content on Hello Pal that caters to the Arabic-speaking world.

In tandem, the Company has also been working with other key partners with an established userbase in the Middle East to ensure quality generation of user traffic to Hello Pal to consume the livestream content. This expansion presents exciting growth prospects for the Company as the Middle Eastern market is a proven market for livestreaming content, yet is relatively still in its infancy.

The Company has already been testing the Middle East market over the past several months, and initial results have been more than encouraging. Notably, largely due to the Middle East efforts, non-China revenue now accounts for 10% of its total revenue, having increased from 6.5% the previous month, and 3% from November 2020. "

The thing is Chinese DO NOT BUY STOCKS! Thus, to make money on the Stock market they have to qualify for the NYSE, NASDAQ or TSX. And they are traded on the Canadian Stock Exchange. So I paid Canadian Dollars.

This great Chinese video spyware is up another 25% today. My position is all green and in the profit. Will ride all the camels along the way.

We can also see that one of our positions the GM Short Call 12MAR21 is up by 1,200% from yesterday. But this is only book value since the contract will expire in 10 days. I can keep the PREMIUM only, there are not additional gains, only losses if any.

But GM made it up over 50% now in the past 2 days and that makes us happy. I hope we will have a great week and an even better next week.

HP.CN

Featured Post

One Day before GDP Release. Whats up with the Qs?

The 28 May 365/385/315/295 QQQ Iron Condor circles between 25% and 30% P/L. If it hits 30% today I will take it off. If it waits until tom...

Popular Post

-

An inverted Treasury yield curve is one of the most reliable leading indicators of an impending recession

-

When we take a look at the past 22 years we can see when ever the 10 Year Treasury Note hit a certain level and the yield curve reversed and...

-

The truth hurts and offends . Most people haven't realized it yet but they have the most information and in excess of all information ...