The RUBEL is about to collapse despite the selling of Foreign currencies by Russia. I am still betting on a interest rate hike by the Feds in 2 weeks due to extreme inflation, caused by the supply chain shortage on top of printing money by the federal reserve. Now the war on Ukraine has created a shortage in energy and energy prices will further inflate and might force the Feds to hike rates. We will also see that the Dear Fuhrer of Canada banned Russian oil. But he wont open the pipeline to Alberta since he wants higher oil and gas prices to push the Communist "Green" agenda. Even Biden is sanctioning the US energy sector. Public land drilling leases and fracking is banned and there is also an energy war with Alaska going on. Energy prices will go up dramatically if they dont improve production and supply. Interest rates will go up and when that happens in combination with high energy prices we might see a recession by the end of this year.

A high inflation and a stagnant economy we call STAGFLATION. This is the stage we are in already.

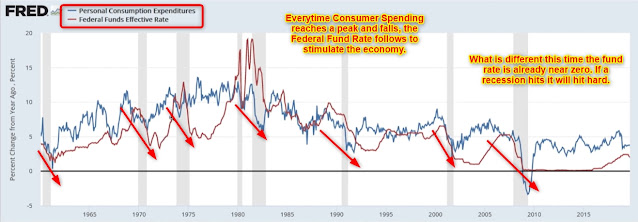

With inflating or dis-inflating prices, consumer will be unable to pay higher prices, inventory will rise, retail sales will drop, manufacturing orders will slow and so production. And the war on the Ukraine will accelerate this process. The GDP will stagnate too. We might slide into a recession.