This week was a sliding down the slope for AMC . As predicted it didnt go below $30. And it will not do tomorrow. It just dipped below 30 for one hour just to come back into the profitable range for the Market Makers.

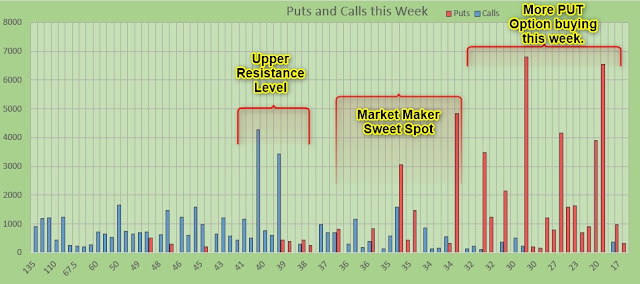

Tuesday the trading volume with Calls vs Puts, was 136% Puts. The tide keeps turning.

Wednesday the trading volume hit 90% CPR , Call to Put Ratio. The Bears are gearing up to push AMC further down.

The Open Interests "CPR", is sitting at 58.66% for this week according to my data and they might vary from broker to broker or data provider to data provider. Nevertheless, they will be outside the range of error.

This week seems bearish and so does next week. Even Apes seldom buy anything beyond their immediate sight, open interests in Put contracts are at 90%. Very high

The least losses, hence the biggest profit for the Market Makers will be in between < $38 - > $33. We have a huge amount of Put contracts sitting at the $30 level. I call it a level now since the puts are concentrated at $30. It is not a spread out "zone".

The price of AMC will not go above $36 with a trading volume of 60% of the average. These Calls are all wasted money, landing in the pockets of Goldman and Sachs. As I said many times before and just think about it, You need an exceptional volume to drive the price up exceptionally in short terms. And buying Call options on a week to week base is super short term trading. Remember there has been above 700 million shares traded to drive the price up on a daily base in May. Now we are creeping at around 60 million. This is 10% of the original squeeze volume . 10%, bro!!

This rocket ship to the moon has no fuel loaded. It is an empty decoy to lure in your money as liquidity for the early Apes. You go in and they get out. They sell to you their seat for a lot of money and they know the tank is empty. They will take your money, guaranteed. If they wont go out, all of you lose over time. To push a car up hill, especially if it is a steep hill, you need a lot of horsepower, fuel or ropes for pulling. Just holding the ropes wont do it and thus, it will roll back.

The Call options at $34, 36, 40 , 45, 50 will disappear tomorrow. The Market Maker cash in, you lose your bet and the Market Maker will own all the long shares. NOW, for them to be sure they will drive the price down with you if you start buying PUT Options. They will cover the underlaying and short AMC . The price goes down and when you take profit they buy AMC back for a lower price and do their profit too, on the slippage and the broker on the commission.

BUT, remember they are sitting on a truck load of long positions and they want to dump them. Thus, the speed downhill will be faster!! Take my word for it.

Since 7, seven, weeks the Ape Army is losing their battle. They cannot drive the price up!! What makes you think they will do it next week?

I am open to think outside the box but you have to come up with some data, any data to support your opinion.

Volume

- In May the trading volume was 380 million up to peak at 750 million PER DAY!!

- In June it dropped to 300 million a day as a high point.

- In July we had 170 million in average and now we barely reach 50% of that.

What you think is going to happen? You think the volume you need to increase the price significantly, and I just mean by 15 Dollars, can be done with 100 million shares daily? Or do you think it will go up by mystical Pixie dust?

RSI

The RSI is showing a divergence since mid of June after AMC peaked beginning of June. The technical aspect.

MACD

MACD is a lagging Momentum indicator to confirm your technical, at least for me. Also here we have a divergence going on in the dailies. The only studies I use.

SMA 5 and 20

In the daily charts we also see that the MA5 broke below the monthly MA, whcih is the SMA20.

I use SMA5, and SMA20, SMA 5 is the weekly base of 5 trading days and there are 20 trading days in a months and so are 250 trading days in a year. I can clearly see if the average of AMC on a weekly base is breaking below the monthly average!

Support and Resistance levels

- The only Support level sits at $30 with 25,000 Put contracts for now.

- The Resistance levels sit at $34, 5,000 Call Contracts.

- The Resistance levels sit at $36, 6,000 Call Contracts.

- The Resistance levels sit at $40, 6,500 Call Contracts.

- The Resistance levels sit at $45, 5,000 Call Contracts.

- The Resistance levels sit at $50, 5,500 Call Contracts.

All (98%) of which will expire this Friday, 6th of August, 2021.

Nevertheless, Fundamental analysis is king and will eventually prevail when people running out of money and losing interest.

Conclusion

Now that we saw the first time that AMC broke through the $29 level it shows me the direction where the Market Maker and the Avenger Apes want to walk. It will not break on Friday. Maybe not even on Monday. Remember, Tuesdays and Wednesday are the important days for options.

For the Bulls this is not very encouraging and next week we might see the further decline. We will see where they place the puts. Three things I will watch out for daily.

- The volume as discussed. Everything below 100 million shares trading volume is nothing. 100 million on the Call Option Side only.

- Unusual Option Trading at the end of a day from Barchart. Compile it in your Excel and eliminate duplicates and keep those options that were mentioned before but not maybe this day. You will see R and S level pretty clearly.

- I will calculate the Sweet Spot of the Market Maker and keeping in mind that they are sitting on a train loads of AMC shares ready to sell at any price. This will create an additional downward pressure when the Revenger Apes start buying Puts.

- All indicators and studies are lagging. Keep that in mind. They only confirm or deny what you already know.