How do we get to the Sweet Spot

Derived from the amount of OPEN INTERESTS multiplied with 100 shares per contract times mid price gives us a good estimate what money is at stake and where the Market Maker will make the most money, or better said will lose the least! This is the spot where the market maker wants to be every Friday when there is Option Payday.

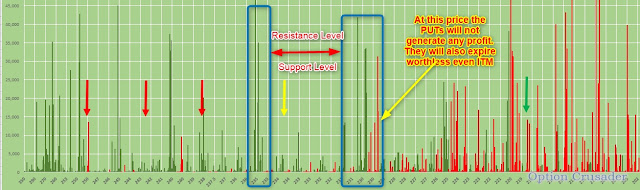

We notice that there are 1.56 Put Options for every Call option as open interests on the books. Traders are bracing for a down turn? We also see that there is a deviation between current price and sweet spot. IMO this might disappear by Friday. Market Makers will mobilizes every opportunity to get the price down. We can see that when the price came down to $224 and $226 that there are much less losses for the Market Makers. The difference is about 400 million Dollars!!

http://www.optioncrusader.com/uncategorized/iwm-market-maker-sweet-spot-calculations/