Friday, June 10, 2022

10 Year Bond Rate is over 3% and Inverted

An inverted Treasury yield curve is one of the most reliable leading indicators of an impending recession

New Inflation Numbers out

The FED has created artificial demand and now a shortage.

New Inflation Numbers out: While loans and credit cards are full of debt consumer confidence at an all time low. I thought it

Thursday, June 9, 2022

Where is the Economy going? Up or down?

Usually a recession starts in the manufacturing sector. And when the layoffs are coming people also start to save on services. But we can see that the development in the service sector is much more dramatic. Inflation is eating everything here.

Tuesday, May 17, 2022

Wheat and Corn Shortages are Coming

And India banned wheat exports on Saturday days after saying it was targeting record shipments this year, as a scorching heatwave curtailed output and domestic prices hit a record high. The Indian Meteorological Department (IMD) defines a drought year as one in which the overall rainfall deficiency is more than 10 per cent of the long period average and more than 20 per cent of the agricultural area is affected.

Friday, May 13, 2022

Consumer Sentiment, Inflation and Market Crash

If you ever wanted to know where inflation comes from, what to do about it, and what happens if nothing is done at all or too late. This is a MUST read. You can read it in different languages including Filipino and German.

Wednesday, May 11, 2022

The Feds must Hike Interest Rates by 100 BP

The Feds must Hike Interest Rates by 100 BP:

And if they do so the stock market will further crash. And if they do not do it, Inflation will accelerate.

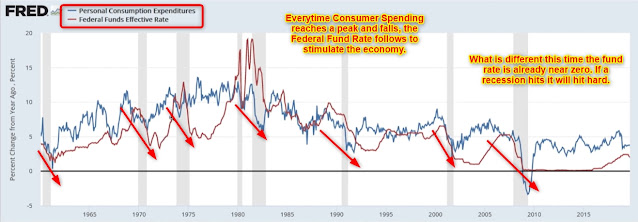

A recession with high inflation is at the door step.

Tuesday, April 12, 2022

Excel Spread Sheet Statistics and the IWM

With calculating expected earning on a stock by calculating the mean profits per day for a certain term we know where we expect the price to be based on history. Now you also can only add the positive days, or for the sake of this exercise take only negative days, and we receive what I call worst case scenarios. Then we can also calculate the Average True Range of an asset and generate a 4 week price target of that. When you look at AFTER 4 WEEKS in the image we have three prices. Then we generate the average of this and have a price target where the stock SHOULD NOT BE within 4 weeks! Then we subtract the current price of the underlaying from that and we get the Deviation from the price. We then look up how many times in the past year a deviation of 18 from the price was hit within 4 weeks and calculate the probability of those occurrences. The calculated deviation of the STRIKE of the short call was hit 3.08%. This means that when you write a call option at that level your win ratio is about 97%!

Sunday, April 10, 2022

More Signs of a Recession, Short the Market

When we take a look at the past 22 years we can see when ever the 10 Year Treasury Note hit a certain level and the yield curve reversed and inverted the crisis hit. The QQQ like other ETFs dropped significantly. The reason this did not happen in late 2018 was because of the implementation the QE, Quantitative Easing, after the financial crisis. Increasing debt, is like printing money for Covid Stimmies and “Free Government Money” or excessive social programs by buying Mortgage Backed Assets and Bonds with it. This increases the Money Stock M2 and leads to inflation. Why? Because more money is chasing fewer goods. Money stock increase should only walk along GDP increase, nationally or globally for the USD. Now that the 10 Year Note is about to hit 2.4% in my opinion the chances are great to trigger the market crash we are all waiting for.

US is in a Recession - Keep Shorting the Market

But one of the most important is the INVERTED YIELD CURVE. Every time you can get more interests for short term assets than for long term assets you invert the interest curve. The only thing is that we call the interest paid on bonds and notes YIELDS. So the yield curve inverts. Below you see what I mean by that.

Tuesday, March 1, 2022

Why it is Time to Short the Market, Part 2

The RUBEL is about to collapse despite the selling of Foreign currencies by Russia. I am still betting on a interest rate hike by the Feds in 2 weeks due to extreme inflation, caused by the supply chain shortage on top of printing money by the federal reserve. Now the war on Ukraine has created a shortage in energy and energy prices will further inflate and might force the Feds to hike rates. We will also see that the Dear Fuhrer of Canada banned Russian oil. But he wont open the pipeline to Alberta since he wants higher oil and gas prices to push the Communist "Green" agenda. Even Biden is sanctioning the US energy sector. Public land drilling leases and fracking is banned and there is also an energy war with Alaska going on. Energy prices will go up dramatically if they dont improve production and supply. Interest rates will go up and when that happens in combination with high energy prices we might see a recession by the end of this year.

A high inflation and a stagnant economy we call STAGFLATION. This is the stage we are in already.

With inflating or dis-inflating prices, consumer will be unable to pay higher prices, inventory will rise, retail sales will drop, manufacturing orders will slow and so production. And the war on the Ukraine will accelerate this process. The GDP will stagnate too. We might slide into a recession.

Monday, February 21, 2022

Why it is Time to Short the Market, Part 1

Wednesday, January 19, 2022

Monday, January 10, 2022

Acceleware mad huge new move

Acceleware made a big move since the beginning of December 2021 due to the fact that it announced that the Company has finished its drilling and completions program for the commercial-scale RF XL pilot project at Marwayne, Alberta. And we can see that the news about was published on December 14th. But the price started moving upwards beginning of December and sky rocketed on December 9th and 10th. I sold my position beforehand in October, thinking to invest it elsewhere in the meantime. My thoughts were that end of December and beginning January 2022 a position in AXE.VN should be regained since the project seemed to move smoothly forward. I was caught a little bit off guard but I still jumped in as soon as I saw the spike climbing, at 0.52 CAD. Price today, 1/10/22 is 70 cents.

Subscribe to:

Comments (Atom)

Featured Post

One Day before GDP Release. Whats up with the Qs?

The 28 May 365/385/315/295 QQQ Iron Condor circles between 25% and 30% P/L. If it hits 30% today I will take it off. If it waits until tom...

Popular Post

-

An inverted Treasury yield curve is one of the most reliable leading indicators of an impending recession

-

When we take a look at the past 22 years we can see when ever the 10 Year Treasury Note hit a certain level and the yield curve reversed and...

-

The truth hurts and offends . Most people haven't realized it yet but they have the most information and in excess of all information ...