I said yesterday and the day before:

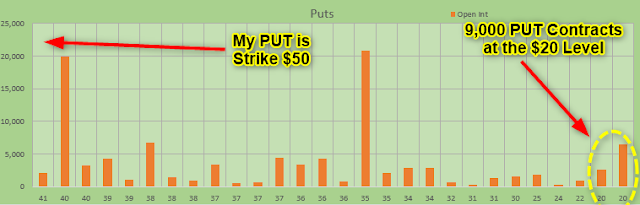

"The Market Maker Sweet Spot moved slightly from $40-38 to $38-35. At $38-35 closing of the week it will have the Market Maker paying out about 5.6 million Dollars. At $33 it would be $11 million so they will stay above that and at $40 it rapidly goes up in costs for them. They will stay below that. Range trading tomorrow as today and Friday will be closing at around 35-36."

We saw today, Thursday 7/29, that the Market Maker cut off the movement at $40 and they succeeded. They handled the situation very well today as the past 2 weeks.

WHY?

The Apes could not come up with call option trading volume! Under 60 million shares traded, falling short on 30% average trading volume. And you have to be above by a lot to make a lot of price movement. This didnt happen. And it will not happen tomorrow either. It would be a miracle. But miracles happen.

What was going on?

Dont trade the first 30 minutes of a day. The Market Makers are loaded with orders from the Investment banks or hedge funds. They get processed first per computer. Here was high volume and the price went up. Since it hit $40 and I said this is the limit for the Market Maker they sold a bunch of shares and created what we call a "Dark Cloud", This candle went down 50% of the first candle with quite a lot of volume. Then the apes came in and were buying their calls for next week because they only buy for one week in advanced because they like to pay a lot of commission to the broker to make them rich. Trade huge volumes and as much as possible.

There was also Put option buying going on but more in the afternoon since the trade volume was 155,000 contracts, of which 63% were call options and 37% were put options. Thus, there is still the sentiment leaning to the upside of AMC with 2:1.

The volume disappeared after 2.5 hours and the Market Maker took over after their lunch break. AMC, again at the $40 level, slid all the way back to $38 at closing. And 37 after market hours. $37-38 is the Sweet Spot of the MM, remember. The MM started selling their excessive long positions to drive the price down, to run the apes out of business. They know exactly where your levels are. And I will tell you as I did before.

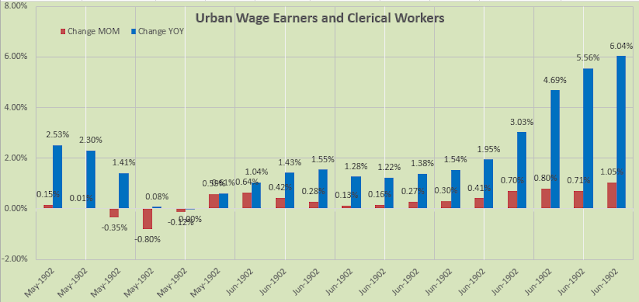

And here is the Market Maker Sweet Spot.

Open contracts to expire tomorrow are 31,683 Put contracts and 70,000 Call contracts. Here is something to think about.

If next week the trading volume will not go above 60% average the Market Maker will be able to handle the price of AMC like a walk in the park. They will be in control of excessive 3.1 million short positions they can always buy back to drive the price up next week!!!

But they also have now additional 7 million long positions in AMC shares to SELL next week in order to drive the price down.

This means in order to drive the price up:

- Firstly, you MUST buy at least the amount of contracts next week as you did this week to keep the price at the existing level since 70,000 contracts expire tomorrow. You have to match the amount to make NO impact AT ALL!

- Secondly, you have to come up with the same volume on top of it to move the price above the existing price level.

- Thirdly, that pressure MUST have longer expiration terms than one week, which becomes much more expensive for the apes and they dont see it. They just eat bananas and the more you promise the more they follow.

- Fourthly, you MUST match every Put option that is bought DELTA wise, means every PUT option will eliminate a CALL option with the same DELTA. You must match that trading volume to drive the price up! With an assumed 30,000 Put options this week, for next week means you have to eliminate them, too.

My conclusion

AMC will not go above $40 tomorrow, because at this level the headache for the Hedgies starts to accumulate. We can also see how well they handled today with a 30% trading volume and yesterday with a 40% and last week with 50% and 60%. They are exactly there where they want to be. The trading volume is fading.

The "Sweet" Sweet Spot is at $37 Dollars now, but either way 38 or 36 is fine. But for sure they also will prefer to go to $35 instead to 40 and to $33 instead to $42. The lower side is cheaper for the Market Makers.

Nothing will change with a low trading volume.

Compared to this week and I assume here ladies and gentlemen, next week the Ape Army could keep their price level if they can buy 70,000 Call option contracts plus 70,000 contracts for the long position of AMC shares that expire Friday (7 million shares), plus the equivalent of DELTA neutral Call options for 30,000 Put Options = 170,000 Call contracts. A daily trade volume at around 100% could make that happen.

Otherwise it is easier to drop the price of AMC since short positions in shares are less than half of the Call contracts due to expired Put options. I think actually only 30% were puts in average. This means to drop AMC you might only need to cover 30% of Call contracts delta wise. It will be easier to break through the downside if the apes cannot make it happen next week.

Read this carefully.