Inflation is here to stay. In Canada we are 1-2 months behind the US. I am just focusing on the US because it is a 10 fold bigger economy and all my trades are done in the US.

So. I put a few charts together from recent data and put some comments to it.

Keep in mind that the wages went up over 6% compared to last year. They will not come down, ever. They will stay were they are. We just can fight inflation so that wages and other costs do not rise too fast. And so are consumer goods. They will stay were they are because that is what the consumer now is used to pay. Inflation is a tax on all people and it hits the poorest the hardest. The elite and big guys dont care what you pay in the store because they they dont see their bills or have to save.

My conspiracy is that the FOMC and Dear Leader Powell are doing it on purpose.

WHY?

The effect will be the destruction of the economy. We will slide down were people become more and more dependent on government subsidies and handouts. High inflation and over regulations will create a Black Market.

That is the goal of the Democrat regime. Socialism or "EQUITY". Everyone will get a fair cut, the same cut, the same toothpaste. Therefore entrepreneurship must be brought to its knees, profit is greed, they say and only the big corporations shall survive because they are in bed with the socialists. The small business is a competition and hence must be eliminated. The Elites eat and you work. Not for yourself but in a big equity producing corporation. The Chinese model is coming, folks. They take your money and pay for all the programs. Not them. And if it all gets to lustful then the rich will just pack their stuff and go to the airport: Singapore.

Get your monthly bread stamps and potato ration. Only tofu and chicken because beef is evil racist.

What should they have done?

I would have though as soon as we hit 3.5% Inflation and the S&P 500, which is also the market indicator, came back to the levels of before the Chinese Commie Virus, the FOMC should have started "tapering". That was end of November. Now we are at faster rising numbers and I will show you some and the legit source.

Now when they start "tapering" and it is not temporary but permanent and at a rising speed, they will have to hit the break hard. No 0.5% every second month or so but more like 2-3%. This will turn the Stock Market upside down. 10-20% losses? Maybe.

Source: https://fred.stlouisfed.org/releases/calendar

You can download the data and do your calculations and graphs. Not too difficult. Just give me the numbers, the facts and not your opinion.

Here are the numbers.

PPI Manufacturing Industry

PPI Finished Goods

These are the prices that will be sold to the Retail Industry. There is high demand, little transportation and a broken supply chain. Container prices for example are through the roof. Shipping from China is getting 2 times as expensive.

Here we can see an inflation around 9% pa!!!

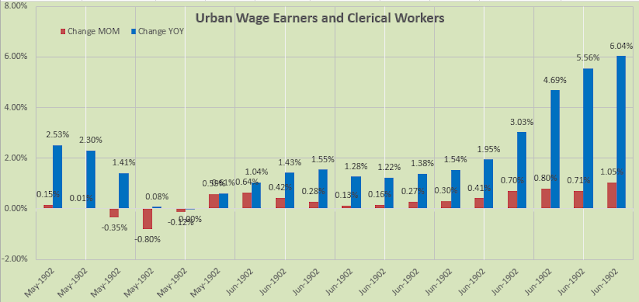

Urban Wage Earners and Clerks

These prices show you the impact from free money and stay at home orders. Wage increases will increase inflation and not your buying power. The only way to increase workers buying power is to reduce taxes on them. They will have more money in their pocket to spend and it will not be an input cost for the company!! Think about it

If you increase wages you increase INPUT COSTS, operating costs of revenue for businesses and that in return will trigger inflation and will be put on your bill when you come and buy your merchandise. Wages are part of CGAC It is an idiotic concept of the left and other idiots to thing with a with a wages increase, like minimum wages that they actually help the poor. NO! Tax cuts do!

Wages are part of OPEX, Operating expenses are the remaining costs that are not included in COGS:

- Rent

- Utilities

- Salaries/wages

- Property taxes

- Business Travel

All Urban Consumer CPI, All items.

These prices represent what you pay in the store and if you want you can break all these numbers into sectors. It is all there. see link above.

And we can see that with the wage increase, hurray, the prices also go up, ohhh. The difference is what you gained of lost. But be aware there is still much more to come. You pay for more than just consumer goods, no?

CPI of Housing in US. Average

These are the housing prices. When the FOMC will start raising interest rates mortgages will go up. Qualification for a loan will become more difficult. The housing market might crash and mortgage banks will take a hit and so will the Home Builders. Go short, Buy Puts!

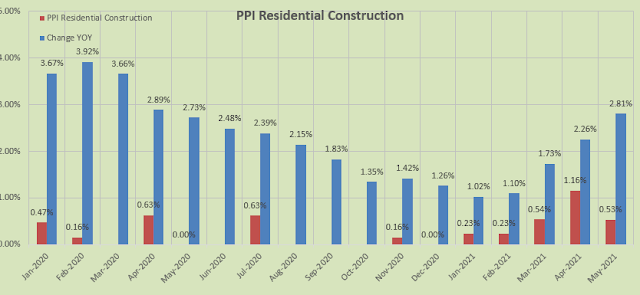

Residential Construction

These are the cost increases for new homebuyer. With increasing home prices and later interest rate hikes, what will happen to this market?

Construction costs go up about 0.5% a month but almost 3% a year. From start to finish this is at least a $15,000 more to pay. Did you qualify for it at the bank? We also notice that construction costs came down massively in 2020. I think this is because they were competing hard due to the China Virus.

Building Material and Suppliers

These costs are about 50% more expensive compared to last year and rising at a pace of 6.5% per month. Did you see what a sheet of drywall costs? OSB boards?

Used Cars and Trucks

Then we have this one here. The cookie of the suckie. Used cars are going up monthly by 10% folks. Here goes all your wage increase back out of the window!!! Believe me now that wage increases do not give you more money? Only tax cuts do! Unions should demonstrate against government money waste and for smaller government and for tax cuts. But not they dont, because they hate capitalism and want you to become depending on government. Hence they are for higher taxes through higher wages. Then the government can pay you subsidies. Hurray!!

No comments:

Post a Comment