If you havent read the blog before do it now before trying to understand any of the following.

Read Theory and Resources first.

Basic Trade Characteristics to consider

- A Bear Call Credit Spread is a trade that consist of two trades. One short call and one long call. We sell a Call for a credit at a calculated level, the Short Call, and hedge this position with a Long Call further away from the short call price. We receive an instant credit for the selling of the call and pay a debit for the call we buy. The further out Call we buy is cheaper than the credit we receive for the first one. Thats why it is a credit spread.

- This is so to not selling a naked call, which would require a lot of collateral capital in your account. Our collateral is limited to the width of the spread times the number of contracts times 100 minus credit received, basically.

- The Bear in the name indicates that we want the market to go down, bearish, or stay ranging, neutral, or even with our setup having a moderate price increase.

- If you would sell a Bull Put Credit Spread at the same time you would create an Iron Condor. Even then having 4 legs in the trade, this trade would be cheaper! Why? Because one side would balance out the other side. Only one side can be loosing, the other side will win. The price cannot be in two location at the same time at closing in our universe. Thats why it only considers the excess of the collateral capital.

- An IC will decay over time and and lose value and hence makes you a profit. If it expires worthless the better for you.

An IC has to stay within a certain range and that would be fine with us since we also would calculate the standard deviations of the Put Spread. BUT, BUT, BUT in face of potential tapering a drop in the market might just shoot the Condor. And that would not be great. The condor will fall out of the sky. - For that reason we have to accommodate more collateral capital per trade and we will make less profit and, most importantly, a Call Spread can run negative until it expires in a market that moves up. Keep this in mind.

- This is from OptionsProfitCalculator.com.

- Also consider that with increasing volatility both, call option prices and put option prices go up and a spread sold in an low volatility environment might turn negative in a more volatile environment. Thus, do not try this option trade with very volatile stocks.

- Thats why best is to sell Call Spreads in an up moving market. You get more for your money and since already a few days of upwards move have happened the possibility of having a few more down turns during the life of the option increases, too. Good for us.

- Lets take a look at the collateral Capital you need to have in place. We chose an example of two contracts. Do how it fits your money management.

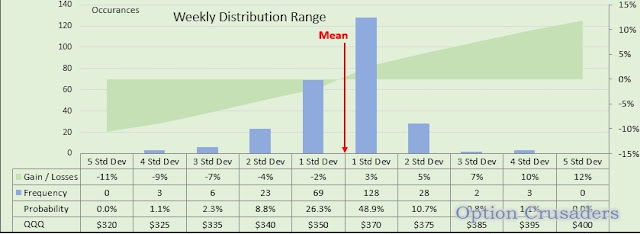

If you would do this as an IC it would get you three times the credit but as I said in these times of potential tapering I will play it safe. - Lets take a look at the distribution of the QQQ. You see how big the wins or losses are at certain StanDevs, how often they occur and what the probability is to be hit. This is all calculated as described in the first blog about it. Just more fancy looking in my world. If you love it you covert it into a science.

Now lets look at the table with the StanDev. Remember, first we filtered out all returns in the spread sheet GREATER THAN ZERO. This is the number in the red circle. This happens in 160 data sets out of 262 = 5 years weekly. This is the WORST CASE SCENARIO for an uptrend based on data from the past 5 years. Why I take 5 years only and not 10 or 20? I want the set to be more leaning to the current market behavior. So I exclude the other years.

Now that the average return of 1.89% happens only in 61.07% of all 262 weeks we have to multiply it with 61.07%. We get the mean Avg Return of 1.158%. The yellow circle. The first number tells you how the market would gain if there were NO negative days or weeks or mixes. The second number takes this into consideration and pretty much draws a straight line from one month to the next. This is like calculating the angle of a trendline.

- The AVG Median UP Trend is calculated per the weekly 1.158% gain

The AVG Worst Case UP Trend is calculated per weekly 1.896% gain

What we see right from the get go is that the worst case scenario is $12 above the Median Up Trend!!The next level up for a short entry is $380. And that is sitting between the 2nd Standard Deviation and the third!! That this will get hit is a probability of 10%.

- This is our SHORT CALL ENTRY at $380

The hedge for the LONG CALL will go $10 above at $390 and there you have it.

- Bringing back the table with the P/L over time from OptionsProfitCalculator.com and see how to establish Stops. I keep my stop loss levels in my head. I dont like to put them out as a stiff snapping trap. Also options are derivatives of an underlaying and hence not follow straight lines as you will see. Anyway.

- Lets assume your Stop will calculate for a $200 loss in any trade. Your BOOK VALUE will be $180 and your MARKET VALUE would be -$380. You received a credit up front and losing that would not be a loss! You just pay it back. So your BE point would be at a MARKET VALUE of -$180.

In this image see the RED LINE in the SAND. You can see that a moderate increase in the Stock price will not make you lose the trade. If the price doesnt move at all you win, if the price of the underlaying falls, you win. This trade just does not like hasty spikes. - Thats pretty much it.

Set these trades up on Tuesdays or Wednesdays and let them run until they expire. Do this weekly. Run a mental SL at minus $200 minus $180 and close it. It is a number game. Like the bank in a casino. - In OptionsProfitCalculator.com the details give this trade a 21% of success. In my calculations we have around 10%. Either way take the more conservative number of 20%.

This means, in our example here, you will lose 4 out of 20 trades. Lets calculate the 20% loss on 20 trades for 20 weeks for this stock alone. - You need about $8,000 to play this game, 4 weeks = 4 running trades

- you might win 16 trades at $180 = 2,880 minus fees

- you might lose 4 x $200 = $800

- Net could be 2,080 minus fees

- The P/L would be about 10% per trade but a trade only lasts 4 weeks each.

- Hence the annualized return would be around 116%

- If you choose to close the trade at 50% level you could write a rule that you are allowed to open a new trade if the Stock Price varies by 2% OR you have 2 days of green candles. Remember we do not chase a trend. We want a flat or bearish market!

- Another scenario to think about is that you could buy another long CALL at the BE line, minus $180, to accommodate for the losses if that might occur. If for whatever reason the stock retreats again and leaves your spread in the money, ITM, and your newly bought Call OTM, you can later also turn it into a credit spread. Thats the beauty of option trading.