My short position on AMC is still valid. 37 PUT 123 DTE.

What happened before

Remember, when AMC crossed above $40 I bought 100 shares and did the little ride up to $45. Took profit but missed the run up to $50.

Then I sold a $42 PUT since it was ranging and created a Diagonal PUT Spread for some credit. This was a mistake! I sold the 42 but should have sold the 39! Why? The $40 level is a strong support level and hence my Put will be 2 Dollars ITM, in the money, at 40. But even I get called out on this one it is still okay. This short leg has another 11 days to live. Lets hope it will die in silence.

What's going on here?

- The overall average volume in AMC is dwindling and is with 93 million daily shares about at the 50% mark of what it was three weeks ago. Trading volume at lunch time NY is around 50 million. Half of the average and about 25% of what it was. This tendency is leaning downwards IMO.

- The Short Ratio is increasing but not because the Short volume is increasing but because the Call trading volume is decreasing! The Apes are losing interest again! Short Ratio is 60%! Up from 30% the weeks before.

- The Option trading volume of AMC is still at #3 in the Barchart Option Activity Score Table. But AMC reaches only 350,000 options of which were 61% Calls. The Short Ratio increased by 4%. This only speaks for the trading volume

- Open Interest Volume tells a more significant story. We have as of now 35,000 Put Option Open Interest and 46,700 Calls. The Call to Put Ratio is 76%. And since the volume of the Short side did not increase much, the Call volume trading decreased we see that the sentiment is turning to the down side.

- There will be so far 82,000,000.00 Dollars to expire this Friday or 57,000 Options contracts.

- I noticed that the Call Option buying volume decreased drastically. At some levels by 90%, mostly 60-75%. But this can still change if there was another March on Rome

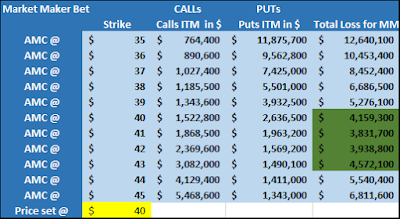

- The Market Maker Sweet Spot is sitting as for now at $40-43. This is where they want to be because they have to pay out the least amount of money.

- The MACD is turning and indicating a confirmation of increased Put Call Ratio and weak Call buy volume.

- AMC is about to cross the MA 20 correlating with the $40 support level. Why MA20? Because there are 20 trading days in a month. You can say AMC is about to drop below your monthly average price. Then there is MA250 for annual average pricing and MA60 for 3-Month average and MA5 for the weekly average. Nothing else makes sense to me.

- We have only 7,500 Calls sitting at the $50 level. Remember that there were about 20,000 before?

Trade Management

If AMC stays below 40 until Wednesday I will have to hedge the $42 PUT by either

- Buying a Put at 39 for about 6 Dollars a piece (my long Puts will outrun the 42 Short Put) or

- Selling a 45/50 Bear Call Credit Spread. But the spread between asking and Bid Price is huge showing huge volatility and the MM are taking advantage of it. To make money here it requires several units. Compare to first suggestion. Not sure yet. Is easy with the QQQs

- Maybe both options at the same time, buy a Put, Sell a Call Spread. Goal is to collect as much money as we spend on the 42 short put.

- If AMC stays within the Market Maker Sweet Spot I just wait for the short leg to die (expire), 11 DTE

General Thoughts

- If you go in on a directional trade (long Call or long Put) chose a longer, 180 or more DTE.

- Do a diagonal Spread. Lets say you buy a call with 180 DTE then also sell a Call either above your strike with little credit but no needed collateral or below your long strike for a higher credit but with collateral calculated from the width of your spread.

- The diagonal spread will have a short leg that will expire and hence you can keep the credit and your long position is cheaper.

- If the trade goes against you hedge it. Sell Puts or Calls for a credit Hedge with a SHORTER time frame, maybe 30 DTE or 14 or so.

- Turn a long Put into a Bull Put Credit Spread if your trade goes up against you

- Turn a long Call into a Bear Call Credit Spread if your trade goes down against you

- Sell Put spreads if your trade goes up against you

- Sell Call spreads if your trade goes down against you

No comments:

Post a Comment