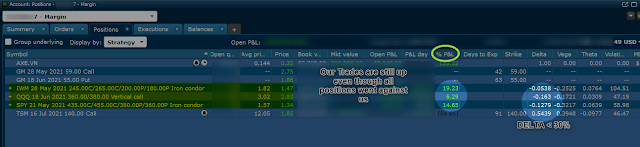

The 28 May 365/385/315/295 QQQ Iron Condor circles between 25% and 30% P/L. If it hits 30% today I will take it off. If it waits until tomorrow for GDP release I hope it will jump up more. But who knows, not me. This is a pretty happy trade with a $8.5 P/L per day per contract. 8 days x 5 contract = $340.00

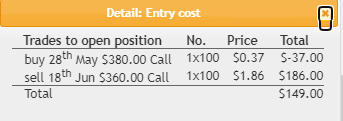

Our entry strategy

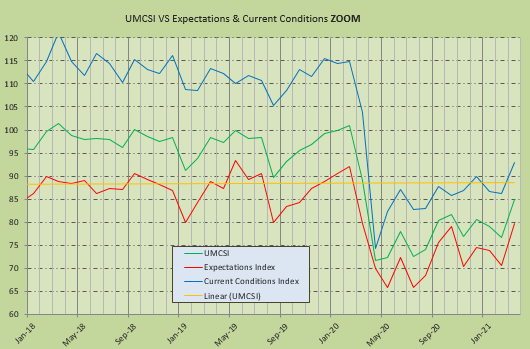

Our chance to get taken out within one week increased slightly from 2 weeks ago. On the CALL side it is 1.9% and on the PUT side it is 3 %. This means in 3 trades out of 100 our position might be taken out within one week if, if, if we dont do anything about it. This is a pretty safe bet. This is like owning the bank in the casino. You dont want to play the slot machine, do you? After two weeks of flat markets the Deviations are still the same in play. So our chance stay the same! 3% if we have to stay in for another week.

Even though the markets are totally flat as we can see options sometimes work magic. The price of QQQ is $339.00 as it was 2 weeks ago! Still our position gained value! Love it.

We can see that we sold the IC for $2.59 per contract on April 21st and the value decreased to $1.93, which is our Buy Back price if we dont want to let it expire, 25% as of now. We would buy it back cheaper as we sold it. Just a reverse trade. Sell high and buy back low.

What would it cost you to make a 25% return on the ETF if you bought it outright as the banks want you to do?

You buy the shares for $339 and add 25%. Thats 423.75. The difference is $84.75. To make a $340.00 Return on Capital, ROC, you had to buy 340 / 84.75 = 4 shares of a total of $1,356.00 and waited for about 9 months!!!! You would have bought 4 shares on July 24th, 2020 to get the same result. Of course you could have doubled your shares and so could I double the contracts! Same thing. Your shares could have gone to ZERO for whatever reason and bear an 100% Risk value because you can lose ALL your money. My risk with 5 contracts is limited to the Spread minus Credit. The spread between short CALL / PUT and long CALL /PUT are 20 Dollars. 500 x 20 = $10,000 - Credit = $8,705 max risk IF the market hits strike price at expiration. But we do not let it come to this since we have our mechanics to limit losses. Remember? We roll out and we roll up or we sell it. And we calculate the chance of being hit at the 3rd DIVIATION, it is safer than buying stocks outright because you know your limits and gains beforehand.

My Option, the Iron Condor did not cost me anything BUT it generated a CREDIT of 1,295 Dollars on 5 contracts that went into my account!!