My prediction for the GDP coming out on Thursday: 19.5 to 20.4 Trillion Dollars. And here is why

Manufacturing Index, PMI. Finally after the Covid impact in 2020 when all numbers turned red we see a bettering in the employment numbers. While orders in manufacturing is picking up as well as production and lagging employment, suppliers cannot keep up. A lot of back orders and prices increasing due to basic material shortages. Import and Export improving since some time.

Unemployment numbers, Continuing Claims and Initial Jobless claims, are below 12 month average and coming down substantial. Even though they are NOT at pre-Covid levels.

Service Sector is also improving. Nevertheless employment is lagging and so is Customers inventory. Exports and Imports are at neutral levels and backlogs are less than in the manufacturing sector. Service Sector is lagging Manufacturing

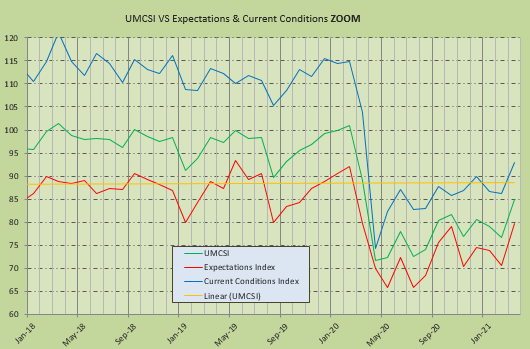

Consumer Sentiment Index is increasing and we can see the impact it had in May 2020 after Covid hit. But it is increasingly becoming better. CSI shows where the economy is going within the next 6 months, up.

Building permits are growing fast and we can see the Covid impact in 2020. On the left side you see the start of the housing crises in 2006! Covid is minimal impacting the economy compared to the Mortgage Lending Crisis accumulating in 2006.

The Chinese Manufacturing Index is retracting while the AUD is not following yet. I assume the AUD will follow the PMI as it always does. But maybe this is also an indication that companies are leaving China. I hope they would. China is a communist country and is enemy Number One of the Free World. Shorting Australian Businesses in the expectation of a AUD decline?

All over all the economy will be recovering for the next 3-6 months. GDP is coming out on Thursday 08:30 ET. My bet is anywhere from 19.5 to 20.4 Trillion USD. The Numbers are just confirming or denying what you think was right but since these important numbers are coming out 4-6 weeks after the Quarter they are old. But we can see the RED is building in the S&P500 in the early 2020 and hence is a leading market indicator. Now we also can see the increasing GREEN color and the S&P500 Buy signal for the coming months. The market seems to move full ahead. The growth on the S&P500 is my upper limit and the growth between the two preceding quarters is my lower limit. Here you have it. The markets wont crash the next three months

END OF THE ECONOMY ASSESSMENT FOR 2021

No comments:

Post a Comment