QQQ did not give me two more bear candles yet. Instead it moved further up. The market is pumped up with money from the government. Sooner than later it will collapse. Inflation is looming. You cannot just print money and say, hey, Everybody gets free money. Capitalism just doesnt work like this.

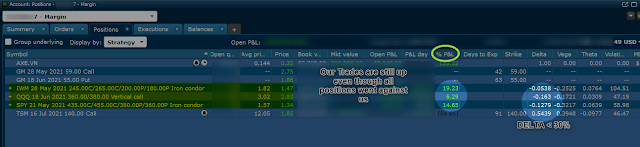

Thus, with QQQ and IWM and SPY rising to new heights our positions are still in the green.

We remember? Waiting on QQQ to hit 331. It didnt happen on Thursday nor on Friday.

All three ETFs hit new highs since three days. See comparison below. QQQ is the least in the money since it is a directional trade. SPY and IWM are market neutral. While QQQ is more a lottery ticket I sold, SPY and IWM are insurances plus lottery tickets. They doing better.

We can see when the entry was and how they moved up AGAINST our position, because QQQ is a short position, a credit spread, contrarian.

I have the feel there is a big retracement coming soon. The market seems too pumped up. The S&P500 is going up since 13 trading days. This are almost 3 weeks!! Never seen that before. One will start closing and then all start selling.

IWM only moved very little. Our profits might be gone when volatility increases. Our short positions become more expensive, hence closing becomes more expensive.

Our positions are still up as we can see in the account. The average wait time for 30-50% profit should be 10 days. As long as DELTA stays below 30% I dont see the need to manage it. Thats what the mechanics are saying, So I expect to close two of the trades next week.

No comments:

Post a Comment