OK Guys. This post will be the detailed description on HOW to put a small pipe into the huge Market River. We like the steady flow. We will divert waters onto our fields to grow our fruits. The fruits of hard labor. So we dont want to become too greedy and breach the dam or flood our fields. We will take out constant water to make our mango trees grow. The more mongo trees we plant the more water we will take out. One Mango Tree at a time. Only in the Philippines money grows on trees, literally. Thus, we will grow money on trees. Which means it becomes a no brainer. Really!

But I also warn you that you need an IQ of at least 115 to understand what I am going to explain. If you dont have that it will not be impossible but difficult for you. If you have any questions ask my wife, she can explain it well. She comes from a village and has an IQ of 115. If I havent pissed you off yet, welcome to the show. Dont feel offended or maybe yes, please. I write this down to get my understanding together as well. This is all new to me too. But I do the research and spend my time on it. So, it is already digested for you.

Call it OPTION DIGEST.

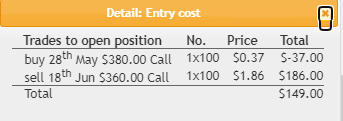

For educational reasons we will buy or sell 1 contract to keep a standard. One contract are 100 shares hence you have to multiply the price of the option by numbers of contracts times 100. Thus, 2 contracts with a price of $1.20 will generate 2 x 100 x 1.2 = $240 Cost or Premium.

Where to start?

We run our example on QQQ. This is one heavily traded ETF but we could use any other one. Out of the data, which can be obtained publicly on finance.yahoo.com we generate a Bell Curve that tells you distribution of the underlaying /stock at any given time and probability of finding your asset price on any section of the curve. This is the most important part of generating your entries. You want to have an estimate of where the price might go and how often.

Why staying outside a potential movement? Dont we want to gain WITH the trend? NO! We dont. We sell premium trades into the market. We want to cash in on the premium and we dont want to lose them back to the market if the market might move against us. So, we stay away! That is the basic concept.

Do I know where the market goes in the next 14 days? Absolutely not. Do I need to know? No! As I said before I do not care where the market goes. I only care about the speed and that it moves. Dont run me over since I need some time to make decisions.

These are weekly data over 5 years. We see where they fall. You can read the probability that this is getting hit within ONE week. It is as low as 1.9%. We plan to keep it for 14 days only and then we will close it. That time frame will also be very low. If you like more risk go with the 1 Std Dev or the 2nd. Up to you. The mean is at where I opened the trade.

In the image, Gain / Losses, they translate into gains or losses but actually describing the move of the underlaying up or down, which translates into gains or losses depending on your strategy. Frequency means how many occurrences we have in the 5 year data set. Probability is how often they might appear. And QQQ stands for the stock price at the given deviation. These will be our entry points.

What is a Bear Call Credit Spread?

AKA a CALL Credit Spread. We assume a bearish development, thats why BEAR. Bears down and Bulls up. We create a Spread, this means we have two options, one at the front, our premium, and one at the back to hedge. This limits our total risk and defines the capital needed in the account. It is a Credit spread since we sell it and collect a premium for it, like someone is buying insurance from me. Your car insurance. Do you always make an accidents? No, but you buy insurance. I sell it for stocks. This is my front option, the short call for premium. And I buy a back option, a CALL for some costs to hedge. This is MY INSURANCE. Like the CHMC insurance you must buy to protect the bank when you buy a house. The difference is the bank puts it on your mortgage payments and I pay it myself. Got it?What is the goal?

- Best Case scenario. The stock price falls and the Call option loses on value. The deeper the price falls the less value for the option, the better. I sold the Spread, buy 380 Call and sell 360 Call, for a $149 profit. 360 is the strike of the short call. I am short on it, I owe it and have to buy it back. 380 is the strike of the long call. I am long, I own it, I can sell it. Now when the price of the underlaying, here QQQ, drops both Calls lose value, the short call, closer to the current price loses compared to the long call, further from the current price, its value in a ratio of 3/5 and both might end up at $75 total. Just to pick a number.

My short Call, the one I owe, becomes cheaper to buy back.

My long Call, the one I own, will also lose money and I can sell it but for less. But all together gives me a profit, always.

Then I Sell 380 and buy 360 and have 149 - 75 = $74.00 per contract. Turn around time in average 14 days. This is about 50% ROC on the trade. Do it twice a months. Sell, buy, profit, rinse and repeat. - Second best scenario. The market stays where it is and does not move much. It does not reach the strike price until expiration. The market is flat and has little to no movement or goes against me but not too far. Then we simply wait and let the option expire after lets say 45 days, the option simply will disappear from the account and we keep 100% of the premium. 100% profit. The disadvantage is that we have to wait a period of time without being able to use the capital.

- Worst Case Scenario. The market moves against our position, the price goes up. My Calls getting more expensive and it will be more expensive to buy them back, loss. Or they threaten to hit the Strike price, max loss starts to become reality.

Thus, yesterday I was waiting for the market to turn around. It didnt. Now we have 13 trading days as an uptrend. This is not real and very, very unlikely but we see it happens. Can we predict the market? No, and I dont care as I said.

After our position accumulated a 30% loss I rolled it. YEAH! You ever heard of rolling stocks out or up? Of course not because you cannot roll a stock if you are losing money.Imaging to roll your stocks back into profit if they lost some value.

Go and ask your banker how to do that. Maybe ask your Mutual Fund manager at the bank. But we can roll options! That is the lovely thing about options if you understand them. And I am getting there.

Now we ended up with more premium, $307 per contract. Deduct $53 and our position turned into gold again. Plus $254 now. More than before since the price action of the stock also drove the prices up for the further dated Calls. And on top of this, our cost base is better now too. We still have the same risk since we didnt widen the spread, it is still 1 x 100 x $20 spread minus Premium.

- In the beginning the max loss per contract could have been 1x100x20 = $2,000 minus $149 = $1,851

- Now with the rolled position our max loss per contract got reduced to $2,000 minus $254 = $1,746

- This also generated a better Break Even Point. So it is a winner never the less.

What did we gain in our worst case scenario?

We made money, our position is up. We collected more premium. We reduced our max loss potential and we got a better break even point, we bought time.

- The best case scenario would have generated a 50% ROC within a short period of time, voluntarily.

- The second best scenario would have generated a 100% ROC within a longer time period, voluntarily or forced by the market.

- The worst case scenario would have generated more than 200% ROC of our original position within any time period, forced by the market.

Will the market come down today? I am not sure. Probably it will. If not we will roll it again. Our Strike is still $20 away and needs about two more weeks to reach it if it runs higher and higher with this speed. This is very unlikely. We just wait for a turn around and collect more premium on the way. If it hits 30% or 40% loss again we will roll it OUT for 14 more days. We can let it gain some more losses and hence our roll will be more lucrative.

There we have it.

And if this is not good enough we will also roll it UP. This means we will put our Spread again further out of the money, OTM. We just move it up and out and out and up! UNTIL. Yes, until the price comes down.

Another option is to create a Bull Put Credit Spread on the other side of the price for a premium out of nothing with the same expiration date as our Call Spread. Thus, we would collect an additional premium, converting our Call Spread into an Iron Condor. I love options!

In order to compensate for the fees involved and the $53 initial loss the stock needs to fall about $5.00 to cover all. Our goal is to close this position anywhere between a 25-50% profit. This is the $307 premium collected divide by 100 equals a 3 Dollar, 50% of it is $1.50 move down on the option. With an DELTA of -15 now for the Position, which means for every dollar the stock moves the option moves $0.15. So we need roughly a $10 move in the stock to make a 50% return.

So the final question is....

Can QQQ drop by 10$

Can it drop from yesterdays close of $341 to $331? Or do we have to roll it first? Or do we have to see it winding down over a few days? This will only the market tell you. Either way is good for me.

Thus, this is the water pipe I am talking about. I do not care where the market goes, up or down or left and right. Sit there or move. Even if the stock price doesnt move at all the option will decay over time. This is the THETA value. What can you do with stocks?

Let me ask you this questions and think about it for a second

- What do you do when you think a certain stock goes up? You buy?

- What do you do if the stock goes down? How to take advantage of it?

- What do you do if the market doesnt move at all? Can you take advantage of it?

- What do you do if the market crashes and threatens to wipe out your holdings?

One thing about Bear Call Credit Spreads is that my position also wins if there is a terror attack and the market crashes like on 9/11. This is also true for another Black Swan event like China's Covid19.

Why? Because the stock prices will collapse and drop as they did due to panic. My calls will be ready to be bought back for nothing. PUTs will be very expensive and so BULL Put Credit Spreads! The markets might be closed for a few days. My calls will be immune.

Thus, this strategy is good for market crashes. Your stocks or ETFs can be wiped out over night or lose tremendous amount of value. ETFs never go up endlessly over night because they are a basket of stocks.

No comments:

Post a Comment